Mortgage borrowing calculator comparison

A mortgage usually includes the following key components. Lenders mortgage insurance calculator Capital gains tax calculator Extra lump sum payment calculator Mortgage repayment calculator Borrowing Power Calculator Income.

Mortgage Comparison Spreadsheet Excel

The comparison rate provided is based on a loan amount of 150000 and a term of 25 years.

. Click Amortization to see how the principal balance principal paid equity and. Click Amortization to see how the principal balance principal paid equity and. This calculator will calculate the monthly payment and interest costs for up to 3 loans -- all on one screen -- for comparison purposes.

You can also see the savings from prepaying your mortgage using 3 different methods. The comparison tables below display some of the variable rate home loan products on Canstars database with links to lenders websites for borrowers in NSW making principal and interest repayments on a. Loan Amount Down Payment Loan Term 1 years 2 years 3 years 4 years 5 years 6 years 7 years 8 years 9 years 10 years 11 years 12 years 13 years 14 years 15 years 16 years 17 years 18 years 19 years 20 years 21 years 22 years 23 years 24 years 25 years 26 years 27 years 28 years 29 years 30 years 31 years 32 years 33 years 34 years 35 years Additional Months 0 mont.

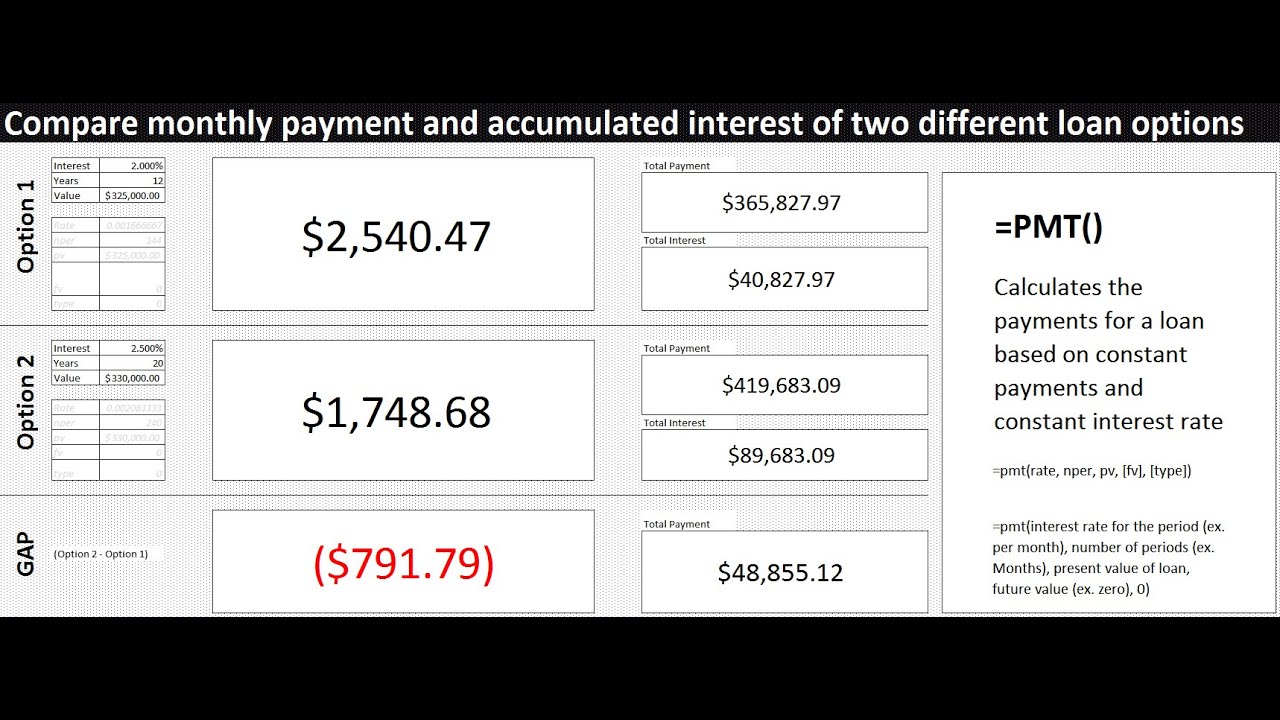

With a capital and interest option you pay off the loan as well as the interest on it. Compare two fixed rate loans with different rates repayment periods. A good monthly home mortgage calculator tells individuals not only if they can afford a selected home but what kind of factors might influence future payments.

Fixed Versus Adjustable Rate Loans. A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments based on a propertys price current interest rates and other factors. Overall mortgage debt tends to grow around 3 to 6 per annum though there can be significant fluctuations in that rate of growth due to factors like BREXIT the global economic crisis which happened in 2008 COVID-19 lockdowns etc.

The mortgage should be fully paid off by the end of the full mortgage term. Freddie Macs 2016 home buyer statistics published on April 17 2017. Interest rates subject to change.

Compare home loans on Canstars database. This mortgage comparison calculator compares loans with different mortgage rates loan amounts or terms. The annual percentage rate or APR is the total borrowing cost as a percentage of the loan amount which includes the interest rate plus any additional fees like discount points and other costs associated with procuring.

The mortgage amortization schedule shows how much in principal and interest is paid over time. The mortgage calculator lets you click Compare common loan types to view a comparison of different loan terms. While online tools such as our mortgage rate comparison tool above.

See how those payments break down over your loan term with our amortization calculator. A chattel mortgage calculator comes up with a repayment amount based on the information you provide using basic arithmetic. At the end of the mortgage term the original loan will still need to be paid back.

How much can I borrow. This Comparison Rate applies only to the example or. This comparison rate is true only for the examples given and may not include all fees and charges.

Segments of the market can change faster than the overall market due to those same sorts of factors along with various legal changes tied to. Different terms fees or other loan amounts might result in a different comparison rate. This comparison rate applies only to the example or examples given.

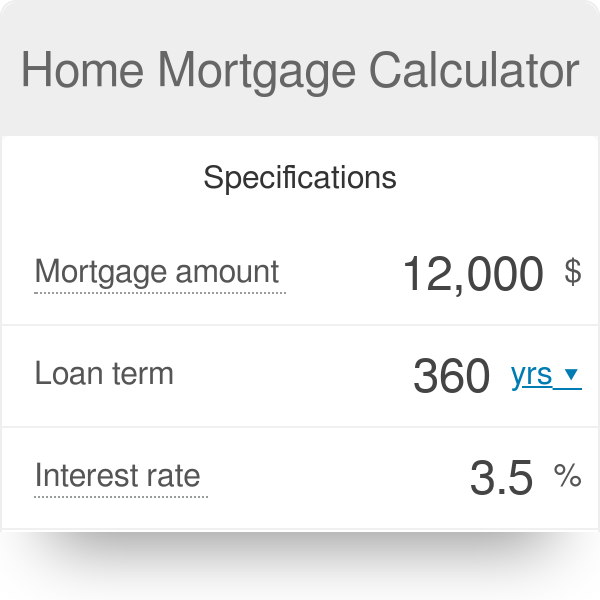

Using our mortgage rate calculator with PMI taxes and insurance. Mortgage calculator - calculate payments see amortization and compare loans. Mortgages are how most people are able to own homes in the US.

The mortgage calculator lets you click Compare common loan types to view a comparison of different loan terms. Use Mortgage Choices borrowing power calculator to work out how much you can borrow for your home loan. These are also the basic components of a mortgage.

Comparison rates are based on a loan of 150000 over a term of 25 years. Your income expenses and deposit are the biggest factors determining your borrowing power but lenders also consider other factors such as your existing debts and if you are using a guarantor for the loan. A low minimum borrowing amount of 2000.

Fill in some simple details find out today. With an interest only mortgage you are not actually paying off any of the loan. Comparison Rate pa.

Especially with rates even the most minute change can have a big impact on your estimated mortgage payments. To calculate the payment amount and the total interest of any fixed term loan simply fill in the 3 left-hand cells of the first row and then click on Compute. Different amounts and terms will result in different.

The comparison rate is based on a loan of 150000 over the term of 25 years. In just 4 simple steps this free mortgage calculator will show you your monthly mortgage payment and produce a complete payment-by-payment mortgage amortization schedule. On a fixed rate mortgage the interest rate remains the same through the entire term of the loan rather than the interest rate doing what is called float or adjustWhat characterizes a fixed rate mortgage is the term of the loan and its interest rate.

Our borrowing power calculator gives you an initial estimate of what a lender may be willing to lend you based on your income and expenditure. In the US the most common mortgage loan is the conventional 30-year fixed-interest loan which represents 70 to 90 of all mortgages. Our borrowing power calculator asks you to enter details including your loan term and interest rate income and expenses and any outstanding debts.

The cost of borrowing money from the lender. Mortgage comparison calculator assists in determining how much you can borrow to achieve an affordable payment or if borrowing more over a longer term can meet your.

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

Discount Points Calculator How To Calculate Mortgage Points

Downloadable Free Mortgage Calculator Tool

Mortgage Comparison Spreadsheet Excel Business Plan Template Agenda Template Business Template

Home Loan Approval Is Quick And Easy With Just One Click Https Www Indiabullshomeloans Com Instant Loan Appr Home Loans Online Mortgage Refinancing Mortgage

Compare And Save Calculator 2022

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Mortgage Payment Calculator Mcap

Make A Spreadsheet To Compare Two Loans Mortgage Easy To Learn In Excel Youtube

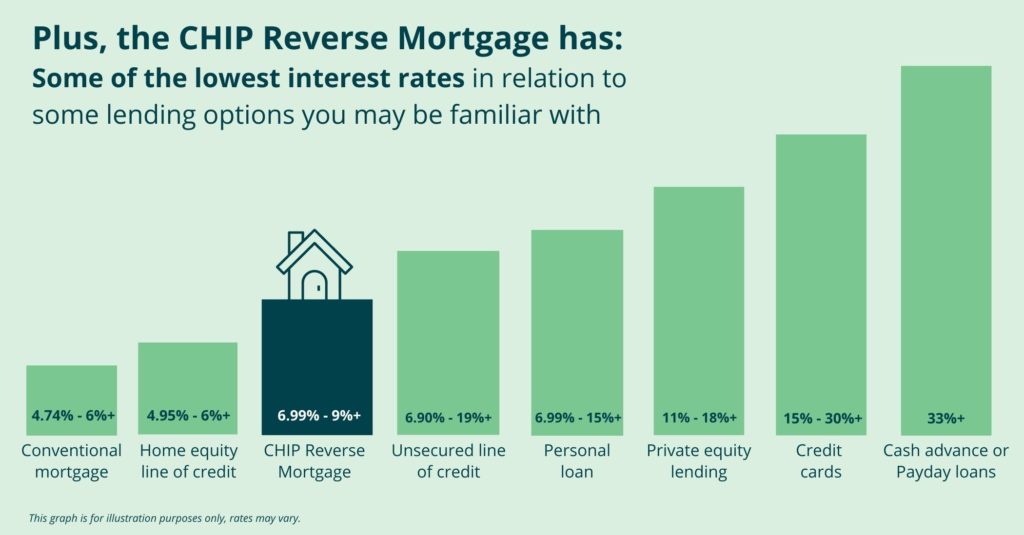

Chip Reverse Mortgage Rates Homeequity Bank

Mortgage Calculation With A Mortgage Comparison Calculator Mls Mortgage Mortgage Loan Calculator Mortgage Comparison Mortgage Estimator

Ever Wonder What Makes Mortgage Rates Go Up And Down Mortgage Interest Rates Mortgage Rates Understanding Mortgages

Home Mortgage Calculator

What S The Difference Between A Home Equity Line Of Credit And A Home Equity Loan Investmentbanking Investment Home Equity Home Equity Loan Line Of Credit

Loan Comparison Spreadsheet Refinancing Mortgage Calculator Etsy Refinancing Mortgage Mortgage Calculator Budget Spreadsheet

Mortgage Tips And Tricks Dynamic Annual Rate Dar Mortgage Comparisons M Reverse Mortgage Mortgage Companies Mortgage Tips

How To Use A Mortgage Calculator Comparewise